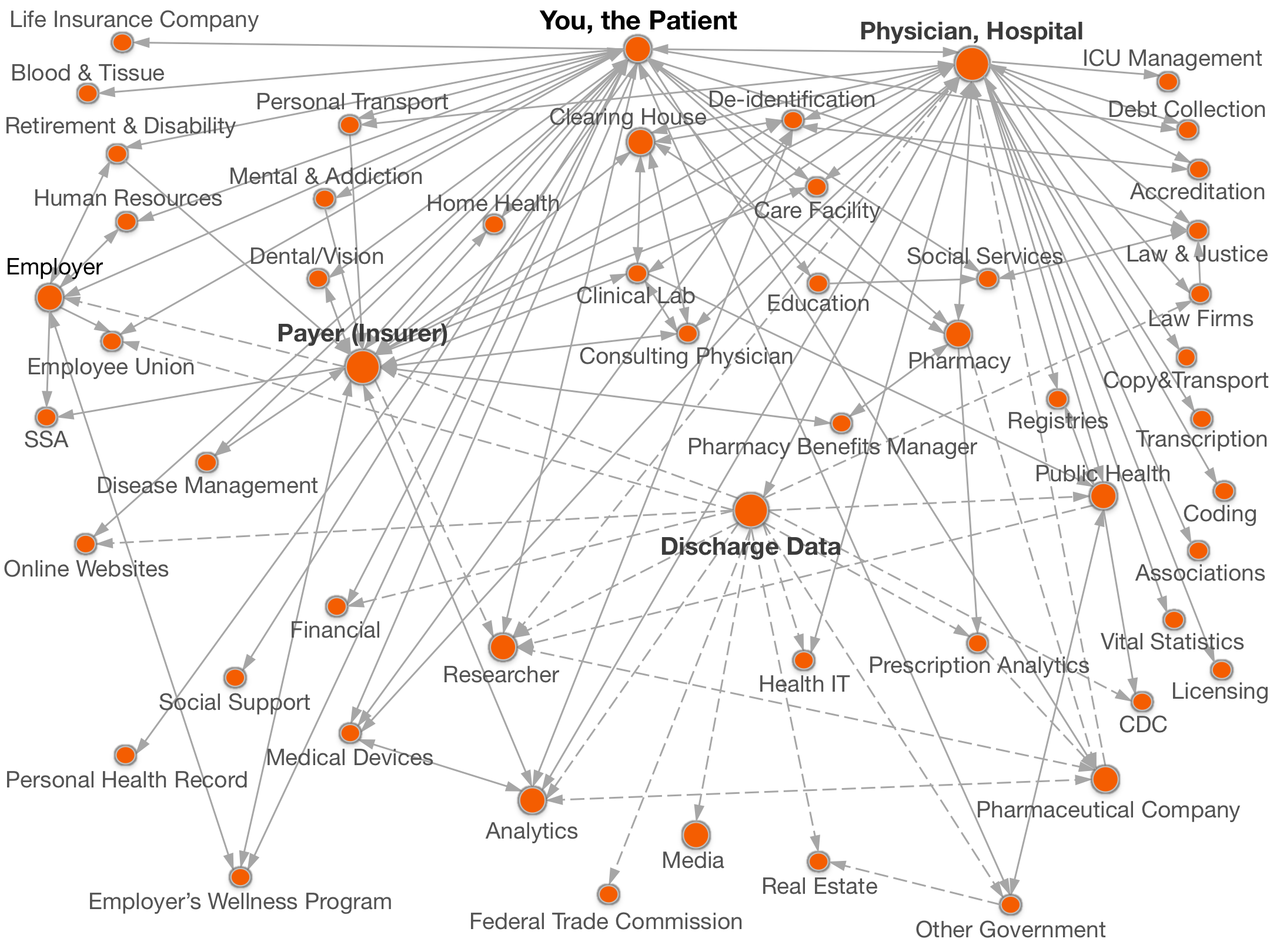

Documenting all the places

personal data goes.

Legend:  with your name,

with your name, without your name.

without your name.

Click on a circle above for names of organizations and details of data shared.

Health payers receive information from you, the patient, statewide discharge data holders, pharmacy benefits managers, employer wellness programs, disease management organizations, de-identification companies and analytics firms and exchange information with researchers.

In general, Health Payers receive detailed medical bills from physicians, hospitals, and clinical laboratories. Bills typically include your name, address, policy number, date of birth, diagnoses, and procedures. Often providers submit bills to insurance companies through clearing houses.

Additionally, a Benefits Manager may play the role of a payer for self-insured employers.

There are many types of insurers:

A common payer is a health insurance company offers insurance against the risk of your personally incurring major medical expenses. By estimating the overall risk of health expenses among a targeted group, the insurance company pays your medical bills and you pay monthly premiums. Often your employer contributes significantly to your monthly premiums and feedback to the employer from the insurance company should be aggregate information that does not include your name. When your employer and your health payer are the same, they are called a Self-Insured Employer.

In comparison, a managed care organization aims to lower healthcare costs by re-organizing and negotiating arrangements directly with physicians. A common variation is Health Maintenance Organizations, which require members to select a primary physician as a doctor who acts as a gate keeper to recommend and approve medical services. Another variation is a Preferred Provider Organization is an organization of physicians, hospitals, and other health care providers who work with an insurer to provide health care at reduced rates.

The largest payer is Medicare, which is a federal program for senior citizens. Medicaid assists at the state level.

Examples

OptumInsight (Ingenix), a division of Minnetonka, Minn.-based UnitedHealth Group Inc., the biggest private U.S. health insurer, owns one of the deepest pools of health data on the planet. Its patient profiles link records from health plans, lab tests, hospital claims, pharmacies and physicians, even demographic information on patients' race, income and net worth. Sales were $2.88 billion last year. OptumInsight purchases statewide personal hospital discharge data from at least 10 states: CA, FL, IL, MD, MA, NJ, NY, PA, TX, WA [source]. The purchased data does not contain the person's name, but it is possible to match some people by name [source]. | Aetna of Connecticut had a data breach in 2010, in Connecticut. A number of insured customers were affected by an unauthorized access or accidental disclosure of personal information in September. [source]. | |

Ingenix (OptumInsight), a division of Minnetonka, Minn.-based UnitedHealth Group Inc., the biggest private U.S. health insurer, owns one of the deepest pools of health data on the planet. Its patient profiles link records from health plans, lab tests, hospital claims, pharmacies and physicians, even demographic information on patients' race, income and net worth. Sales were $2.88 billion last year. They purchase statewide personal hospital discharge data from at least 10 states: CA, FL, IL, MD, MA, NJ, NY, PA, TX, WA [source]. The purchased data does not contain the person's name, but it is possible to match some people by name [source]. | Aetna, Nationwide, WellPoint Group Health Plans, Humana Medicare, Mutual of Omaha Insurance Company, Anthem Blue Cross Blue Shield via Concentra Preferred Systems had a data breach in 2006, in Ohio. A lockbox holding personal information of health insurance customers was stolen Oct. 26. Thieves broke into an office building occupied by insurance company vendor, concentra Preferred Systems. The lockbox contained computer backup tapes of medical claim data for Aetna and other Concentra health plan clients. Exposed data includes member names, hospital codes, and either sSNs or Aetna member ID numbers. SSNs of 750 medical professionals were also exposed. Officials downplay the risk by stating that the tapes cannot be used on a standard PC. UPDATE (12/23/06): The lockbox also contained tapes with personal information of 42,000 NY employees insured by Group Health Insurance Inc.) uPDATE(1/24/07): Personal data of 28,279 Nationwides Ohio customers were also compromised. 2/11/10 Total changes to 396,279 to reflect final total of records breached in all of the affected companies. (396279 records involved) [source]. | |

Acs Government Healthcare purchases statewide personal hospital discharge data from at least CA [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Affinity Health Plan had a data breach in 2010, in New York. Affinity Health Plan, a New York managed care service, is notifying more than 400,000 current and former customers employees that their personal data might have been leaked through the loss of an unerased digital copier hard drive. Some personal records were found on the hard drive of a copier found in a New Jersey warehouse. The copier had previously been leased by Affinity and was then returned to the leasing company. Affinity Health Plan says it has not had a chance to review the data found on the copier. The figure of 409,262 notifications includes former and current employees, providers, applicants for jobs, members, and applicants for coverage. (409,262 records involved) [source]. | |

Aetna purchases statewide personal hospital discharge data from at least FL [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | American Association of Retired Persons, AARP Insurance had a data breach in 2010, in District Of Columbia. A client received another clients information in an insurance policy letter. He attempted to trace the mistake and notified the organization that underwrites AARPs life insurance program, New York Life Insurance. It is unknown how this error occurred and client names, phone numbers, policy numbers, check account information and dates of birth could have been exposed. [source]. | |

AHCA purchases statewide personal hospital discharge data from at least FL [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | American Fidelity Assurance Company had a data breach in 2010, in Oklahoma. Storage containers with Social Security numbers, names, dates of birth and other information were left on a curb in Edmond, Oklahoma. A couple went to the local news after having stored the hundreds of documents for a few years. The insurance papers are from 2003 and 2004 and have information on employees of multiple companies. [source]. | |

America Health Insurance Plans Center For Policy And Research purchases statewide personal hospital discharge data from at least NY [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | American International Group (AIG), Indiana Office of Medical Excess, LLC had a data breach in 2006, in New York. The computer server was stolen on March 31 containing personal information including names, social Security numbers, birth dates, and some medical and disability information. UPDATE(1/12/2010) A 28-year-old Indianapolis man was sentenced today to two years in state prison for trying to extort $208,00 from an insurance company after stealing a computer server. In March 2006, the man burglarized the indianapolis office of AIG Medical Excess, threatening to release clients personal data on the Internet. The server contained the names of more than 900,000 insured persons, as well as their personal identifying information, and confidential medical information and e-mail communications. At the time of the burglary, the man was an employee of a private security firm that provided security services to the insurance company. On July 23, 2008, Stewart delivered a package to the insurance company. The package included a letter stating that he possessed the stolen server and its confidential data. He asked for $1,000 a week for four years, but the FBI and others intervened. The indiana State Police, the Indiana Department of Natural Resources, indianapolis Metropolitan Police Department, and Attorney General also were part of the investigation. (930,000 records involved) [source]. | |

Anthem BC/BS of Maine purchases statewide personal hospital discharge data from at least ME [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Ameritas Life Insurance Corp. had a data breach in 2012, in Nebraska. A laptop was stolen or discovered stolen sometime around March 21, 2012. It contained the sensitive health information of 3,000 people. The incident was posted on the HHS website on June 8.UPDATE(08/03/2012): An official notice states that an employee notified Ameritas that their laptop and other items were stolen from their car on March 21. The laptop contained information used to provide group dental and vision quotes, as well as individual member enrollment information for employer-sponsored group health plans. The laptop was password protected but not encrypted. Names, Social Security numbers, addresses, dates of birth, and places of employment may have been exposed. (3,000 records involved) [source]. | |

Anthem Blue Cross/ Wellpoint Inc purchases statewide personal hospital discharge data from at least CA [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Anthem Blue Cross had a data breach in 2011, in California. Letters soliciting dental and vision coverage were mailed to current Anthem customers. A priority code composed of the customers Social Security number and two extra digits was printed on the outside of each envelope. One customer noticed the error and contacted the media. Anthem admits that an error occurred, but did not reveal the cause. Anthem is working to prevent this type of breach from happening again and was in the process of notifying customers of the error as of May 12.UPDATE(10/01/2012): Anthem experienced the marketing mailer error on April 27, 2011. The State of California settled with Anthem in September of 2012. Anthem agreed to pay $150,000 and to make significant improvements to its data security procedures to prevent future errors of a similar type.. (31,125 records involved) [source]. | |

Av Med Health Plans purchases statewide personal hospital discharge data from at least FL [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Anthem Blue Cross, WellPoint had a data breach in 2010, in California. More than 200,000 Anthem Blue Cross customers this week received letters informing them that their personal information might have been accessed during a security breach of the companys website. Only customers who had pending insurance applications in the system are being contacted because information was viewed through an on-line tool that allows users to track the status of their application. Social Security and credit card numbers were potentially viewed. Anthem Blue Cross merged with WellPoint in 2004.UPDATE (6/29/2010): Around 470,000 customers in 10 states were notified of the breach. The original story states that only applicants were affected, but existing customers also received notification of a possible breach of their information.UPDATE (7/12/2010): 20,000 Louisville, Kentucky residents received notification that a security mistake online resulted in the exposure of their Social Security numbers and financial information. It is unclear whether these residents are included in the original 470,000 customers. Only customers who were self insured were affected. WellPoint is claiming that this and other recent breaches were committed by an attorney or attorneys attempting to gain information for a lawsuit against WellPoint.UPDATE (9/17/2010): An Anthem applicant whose information was exposed by the breach filed a lawsuit against Anthem at the Los Angeles County Superior Court. The lawsuit claims that the breach exposed applicants and clients to identity theft. An applicant behind the lawsuit is seeking class action status.UPDATE (10/29/2010): The office of the Attorney General of Indiana is suing WellPoint Inc. because of the companys delay in notifying customers of the breach. WellPoint is accused of violating an Indiana law that requires businesses to provide notification of breaches in a timely manner and faces $300,000 in fines. State officials believe WellPoint was aware of the exposure in late February, but waited until June to notify customers.UPDATE(7/5/2011): WellPoint Inc. will pay Indiana a $100,000 settlement for violating a 2009 data breach notification law. Customer data was accessible between October 23, 2009 and March 8, 2010. One or more consumers informed WellPoint of the problem on February 22, 2010 and again on March 8, 2010. WellPoint began notifying consumers on June 18, 2010. (470,000 records involved) [source]. | |

Blue Cross & Blue Shield Of Florida purchases statewide personal hospital discharge data from at least FL [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | AvMed Health Plans had a data breach in 2010, in Florida. AvMed Health Plans announced that personal information of some current and former subscribers may have been compromised by the theft of two company laptops from its corporate offices in Gainesville. The information included names, addresses, phone numbers, Social Security numbers and protected health information. The theft was immediately reported to local authorities but attempts to locate the laptops have been unsuccessful. AvMed determined that the data on one of the laptops may not have been protected properly, and approximately 80,000 of AvMeds current subscribers and their dependents may be affected. An additional approximate 128,000 former subscribers and their dependents, dating back to April 2003, may also have been affected.UPDATE (06/03/2010): The theft of the laptops compromised the identity data of 860,000 more Avmed members than originally thought. The total now nears 1.1 million.UPDATE (11/17/2010): Five AvMed Health Plans customers filed a class-action lawsuit against the health insurer on behalf of the 1.2 million people who were affected by the breach. At least two of them believe that their personal information was misused as a result of this particular breach.UPDATE (09/24/2012): An appeals court ruled that the plaintiffs were explicitly able to prove a link between the breach and ID theft they incurred. The case had been thrown out by a lower court in August 2011, but the appeal ruling may allow victims of identity theft to make it easier to prove that the identity theft was caused by a data breach. (1,220,000 records involved) [source]. | |

California Medical Assistance Commission purchases statewide personal hospital discharge data from at least CA [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Ayuda Medical Case Management had a data breach in 2012, in Texas. Thousands of patient records were found in an unsecured trash can. They contained names, Social Security numbers, addresses, phone numbers, medical conditions, and treatment information. The boxes of medical records were traced to Ayuda, whose owner claimed to have been doing little or no business after losing a state contract in September. The boxes were auctioned off after the owner failed to pay the rental fee on a storage unit. (2000 records involved) [source]. | |

Capital District Physicians Health Plan purchases statewide personal hospital discharge data from at least NY [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | BB&T Insurance had a data breach in 2008, in Virginia. A BB&T Insurance laptop containing the personnel information of some Harrisonburg City Schools employees was stolen. The laptop, used by an outside sales representative to develop an insurance proposal for the school system, was stolen from a car. The information contained names, dates of birth, Social Security numbers, and, in some cases, medical history. [source]. | |

Capital Health Plan purchases statewide personal hospital discharge data from at least FL [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Benefits Resources, Inc. had a data breach in 2011, in Ohio. A portable electronic device was lost or stolen on or around November 22, 2010. It contained the PHI of patients. [source]. | |

Centene Corporation purchases statewide personal hospital discharge data from at least WA [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Blue Cross and Blue Shield of Florida (BCBSF) had a data breach in 2011, in Florida. An April 2011 mailing error caused 3,500 member healthcare statements to be mailed to incorrect addresses. The statements were mailed to the former addresses of members and contained names, insurance numbers, diagnoses codes and descriptions, procedure codes and descriptions, prescription names and provider names. [source]. | |

Childrens Healthcare Of Atlanta purchases statewide personal hospital discharge data from at least FL WA [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Blue Cross and Blue Shield of Georgia had a data breach in 2008, in Georgia. Benefit letters containing personal and health information were sent to the wrong addresses last week. the letters included the patients name and ID number, the name of the medical provider delivering the service, and the amounts charged and owed. A small percentage of letters also contained the patients social Security numbers. (202000 records involved) [source]. | |

Coventry Health Care purchases statewide personal hospital discharge data from at least CA [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Blue Cross and Blue Shield of North Carolina had a data breach in 2006, in North Carolina. Social Security numbers of members were printed on the mailing labels of envelopes with information about a new insurance plan. Those who were affected were contacted immediately. (629 records involved) [source]. | |

Dirigo Health Agency purchases statewide personal hospital discharge data from at least ME [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Blue Cross and Blue Shield of Rhode Island (BCBSRI) had a data breach in 2010, in Rhode Island. A filing cabinet containing survey information from approximately 12,000 BlueCHIP for Medicare members was donated to a local nonprofit organization. The surveys were from 2001 to early 2004 and contained information such as names, Social Security numbers, telephone numbers, addresses and Medicare Identification numbers. (12,000 records involved) [source]. | |

DMHC purchases statewide personal hospital discharge data from at least CA [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Blue Cross Blue Shield Association had a data breach in 2010, in Illinois. An error in the quarterly address update process resulted in the mailing of approximately 15,000 individuals protected health information to incorrect addresses. The information in the letters included demographic information, explanation of benefits, clinical information, and diagnoses. The returned mail was collected and the organization verified whether or not it had been delivered. [source]. | |

Empire Health purchases statewide personal hospital discharge data from at least WA [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Blue Cross Blue Shield Florida had a data breach in 2011, in Florida. A system error caused mail to be sent to the wrong addresses. Current and former addresses were mixed up and mail containing an explanation of benefits was sent to incorrect (former) addresses.UPDATE(4/15/2011): The mailing error occurred on October 16, 2010 and was discovered in late January of 2011. [source]. | |

Harris County Healthcare Alliance purchases statewide personal hospital discharge data from at least TX [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Blue Cross Blue Shield of Alabama had a data breach in 2010, in Alabama. A dishonest employee was charged with identity theft. The employee fraudulently obtained credit by using the health insurance information of at least 15 clients. (15 records involved) [source]. | |

Harvard Pilgrim Health Care purchases statewide personal hospital discharge data from at least NY ME [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Blue Cross Blue Shield of Massachusetts (BCBS) had a data breach in 2012, in Massachusetts. A BCBS vendor misused BCBS employee information. The misuse appears to have been limited to one instance. Names, Social Security numbers, dates of birth, compensation information, and bank account information may have been exposed. (15000 records involved) [source]. | |

Health First, Inc. purchases statewide personal hospital discharge data from at least FL [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Blue Cross Blue Shield of Michigan (BCBSM), Tstream Software had a data breach in 2011, in Michigan. A BCBSM website created by Tstream was the source of a breach. A BCBSM found her personal information online when searching her name. People applying for individual health insurance between 2006 and an unclear date had their names, Social Security numbers, addresses and dates of birth exposed. BCBSM was notified of the error on November 17, 2010. The information was accessible for an unspecified amount of time. Though 6,500 BCBSM members were notified, only 2,979 were affected. (2979 records involved) [source]. | |

Health Scope Inc purchases statewide personal hospital discharge data from at least CA NJ FL [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Blue-Cross Blue-Shield of Western New York had a data breach in 2008, in New York. A laptop hard-drive containing vital information about members has gone missing. Blue-Cross Blue-Shield of Western New York says it is notifying its members about identity theft concerns after one of its company laptops went missing. (40,000 records involved) [source]. | |

HFN, Inc. purchases statewide personal hospital discharge data from at least IL [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | BlueCross Blue Shield of North Carolina had a data breach in 2012, in North Carolina. A mailing software error caused the private information of current and former Blue Cross Blue Shield members to be mailed to other members. The error was discovered on April 12. The records were more than 10 years old and included patient names, Social Security numbers, type of medical care received, and other protected health information. (100 records involved) [source]. | |

Horizon Healthcare Innovations purchases statewide personal hospital discharge data from at least NJ [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | BlueCross BlueShield (BCBST) had a data breach in 2010, in Tennessee. The theft of 57 hard drives from a BlueCross BlueShield of Tennessee training facility last October has put at risk the private information of approximately 500,000 customers in at least 32 states. The hard drives contained 1.3 million audio files and 300,000 video files. The files contained customers personal data and protected health information that was encoded but not encrypted, including: names and BlueCross ID numbers. In some recordings-but not all-diagnostic information, date of birth, and/or a Social Security number were exposed. BCBS of TN estimates that the Social Security numbers of approximately 220,000 customers may be at risk. UPDATE (4/29/10): The number of plan members whose data were exposed has grown from 521,761, an estimate made in March, to nearly one million, as of April 2, according to a report issued by Mary Thompson, spokeswoman for the Tennessee Blues.UPDATE (11/3/10): According to a letter sent to the New Hampshire Attorney Generals Office, the total number of individuals affected was 1,023,209. BCBS used a three-tier system to categorize individuals affected by the breach. The total includes 451,274 clients whose Social Security numbers were involved, 319,325 clients whose personal and diagnostic health information was involved and 239,730 clients who had personally identifiable information that was neither medical nor their Social Security number. BlueCross Blue Shield also reported receiving fewer than 10 requests for credit restoration services from those who had their Social Security numbers exposed.UPDATE(3/14/2012): Blue Cross Blue Shield of Tennessee (BCBST) reached a $1.5 million resolution agreement with the U.S. Department of Health and Human Services. BCBS of Tennessee kept the drives and network data closet in a facility that was secured by a property management company. The closet was secured by biometric and keycard scan security with a magnetic look and an additional door with a keyed lock. BCBST eventually vacated most of the leased office space. Thieves may have taken the opportunity to steal the 57 unencrypted hard drives from the closet while the space was not fully occupied. (451,274 records involved) [source]. | |

Jefferson Healthcare purchases statewide personal hospital discharge data from at least WA [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | BlueCross BlueShield of Western New York, HealthNow New York Inc., Administrative Services of Kansas had a data breach in 2006, in New York. The laptop of an employee of HealthNows outside claims vendor Administrative Services of Kansas was stolen during the lunch break of a presentation. The laptop had potential member names and Social Security numbers. The theft occurred sometime around June 19 and notification letters were sent on October 16. (96 records involved) [source]. | |

Kaiser Foundation Health Plan purchases statewide personal hospital discharge data from at least CA WA [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Buckeye Community Health Plan had a data breach in 2006, in Ohio. Four laptop computers containing customer names, Social Security numbers, and addresses were stolen from the Medicaid insurance provider. (72,000 records involved) [source]. | |

Maine Community Health Options purchases statewide personal hospital discharge data from at least ME [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Cahaba Government Benefit Administrators LLC had a data breach in 2011, in Alabama. On April 11, 2011, someone discovered that sensitive paper records had been disclosed to outside parties or accessed without authorization. Centers for Medicare and Medicaid Services (CMS) uses Cahaba for administration of Medicare fee-for-service programs. [source]. | |

Maine Health purchases statewide personal hospital discharge data from at least ME [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | CalOptima had a data breach in 2009, in California. Personally identifiable information on members of CalOptima, a Medicaid managed care plan, may have been compromised after several CDs containing the information went missing. the unencrypted data on the CDs includes member names, home addresses, dates of birth, medical procedure codes, diagnosis codes and member iD numbers, and an unspecified number of Social Security numbers. the discs had been put in a box and sent via certified mail to CalOptima by one of its claims-scanning vendors, according to a statement by the health plan. CalOptima received the external packaging material minus the box of discs. (68,000 records involved) [source]. | |

Maine Health Alliance purchases statewide personal hospital discharge data from at least ME [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Catalyst Health Solutions, Alliant Health Plans, Inc. had a data breach in 2012, in Georgia. An unauthorized disclosure resulted in the exposure of protected health information. The breach occurred on or around January 1, 2012 and was reported on April 17. This incident was reported on the HHS website. [source]. | |

Medicaid and CHIP Payment and Access Commission (MACPAC) purchases statewide personal hospital discharge data from at least ME [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Centers for Medicare & Medicaid Services (CMS) had a data breach in 2012, in Maryland. The CMS experienced 13 breaches between September 23, 2009 and December 31, 2011. The CMS failed to notify beneficiaries of seven of the breaches in a timely manner. The HHSs Office of the Inspector General (OIG) also alleges that the notifications mailed to beneficiaries did not disclose what type of information had been exposed, the date the breach occurred, or how CMS was working to prevent future breaches. [source]. | |

Northwest Washington Medical Bureau purchases statewide personal hospital discharge data from at least WA [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Centra had a data breach in 2010, in Georgia. A laptop was stolen from the trunk of an employees rental car overnight on November 11. Patient names and billing information were on the laptop. The delay in notification occurred because of the time it took to determine what information was on the stolen laptop.UPDATE (1/14/11): The total number of affected individuals was changed from 13,964 to 11,982. [source]. | |

NovaHealth purchases statewide personal hospital discharge data from at least ME [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Central States Southeast and Southwest Areas Health and Welfare Fund had a data breach in 2012, in Illinois. An incident occurred on July 31 that may have caused sensitive health information to be exposed. The information was in the form of paper records that were exposed in some undisclosed way. [source]. | |

Pacific Business Group On Health purchases statewide personal hospital discharge data from at least CA [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | City of Virginia Beach, Flexible Benefits Administrators had a data breach in 2007, in Virginia. A former employee allegedly stole Virginia Beach city and school district employees personal information and used it to commit prescription fraud. Police discovered a list of names and Social Security numbers at the employees home. (2,000 records involved) [source]. | |

Pacificare Health System purchases statewide personal hospital discharge data from at least WA [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Colorado Department of Health Care Policy and Financing had a data breach in 2010, in Colorado. A hard drive containing personal information for clients enrolled in state-provided health insurance was stolen from the Colorado Office of Information Technology. The information included names, state ID number and the name of the clients program. The Agency is certain that contact information, financial information and Social Security numbers were not involved. [source]. | |

Pacificare Of Washington purchases statewide personal hospital discharge data from at least WA [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Colorado Department of Health Care Policy and Financing (HCPF) had a data breach in 2011, in Colorado. A disk with the information of medical-aid applicants was lost on its way between HCPF and another agency. It contained applicant names, state identification numbers, and addresses. The disk was discovered missing on May 6. [source]. | |

Parkland Health & Hospital System purchases statewide personal hospital discharge data from at least TX [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Colt Express Outsourcing Services, CNET Networks had a data breach in 2008, in California. Burglars stole computer systems from the offices of the company that administers the Internet publishers benefit plans. The computers contained names, birth dates, Social Security numbers and employment information of the beneficiaries of CNETs health insurance plans. CNET was only one of several clients affected. uPDATE (8/26/08): Among the companies whose staffers have been exposed by the Colt break-in in Walnut Creek, California: Google, Bebe Stores, Alston & Bird, and the California Bankers Assn. (17241 records involved) [source]. | |

Premera Blue Cross purchases statewide personal hospital discharge data from at least WA [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Commerce Banc Insurance Services (CBIS) had a data breach in 2007, in New Jersey. A CBIS vendor had a laptop stolen. CBIS employees may have had their names, Social Security numbers, and possibly health information exposed. (12876 records involved) [source]. | |

Regence Blue Shield purchases statewide personal hospital discharge data from at least WA [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Concordia Plan Services (CPS) had a data breach in 2011, in Missouri. Microfilm that contained the plan enrollment information of benefits members was lost by a delivery service sometime between February and May of 2011. It contained names, addresses, dates of birth and in some cases Social Security numbers and limited medical information from the 1960s and 1970s. A vendor received the microfilm from CPS on February 3rd. The vendor attempted to transfer the microfilm to another company, but learned that the microfilm had been misplaced sometime prior to or during May. CPSs vendor informed them of the situation on August 23. [source]. | |

Tricare Interactive purchases statewide personal hospital discharge data from at least NY [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Connextions, Anthem Blue Cross Blue Shield of Indiana, Anthem Blue Cross Blue Shield of Ohio, Empire Blue Cross Blue Shield of Indiana had a data breach in 2013, in Florida. A Connextions employee used Social Security numbers from a number of other organizations for criminal activity. At least four members of Anthem Blue Cross and Blue Shield were affected by the criminal activity. The breach was reported on HHS as affecting 4,814 patients, but more were affected. (6,000 records involved) [source]. | |

Scott & White Health System purchases statewide personal hospital discharge data from at least TX [source]. See more information about the fields of data shared, an example of matching real names to the records in statewide discharge data, and which states use standards less than the HIPAA standard. | Cover Tennessee had a data breach in 2007, in Tennessee. A computer error at the Cover Tennessee health insurance program caused small business owners who chose not to print out their forms from the Web site to have their personal information including Social Security numbers added to the next users printout request. (279 records involved) [source]. | |

[24]7.ai. had a data breach in 2017, in California. A payment card breach suffered by [24]7.ai. between September 26 and October 12, 2017, is impacting major firm, including Best Buy, After Delta Air Lines and Sears Holdings.The intrusion occurred between September 26 and October 12, 2017. "We understand malware present in [24]7.ai’s software between Sept. 26 and Oct. 12, 2017, made unauthorized access possible for the following fields of information when manually completing a payment card purchase on any page of the delta.com desktop platform during the same timeframe: name, address, payment card number, CVV number, and expiration date." reads the advisory published by Delta Airline."No other customer personal information, such as passport, government ID, security or SkyMiles information was impacted." [source] | 1-800-Flowers had a data breach in 2016, in New York. 1-800-Flowers customer service received reports on February 15, 2016 from customers that they couldn't complete their online orders. The company investigated and discovered from February 15th, 2016 through February 17th, 2016 orders that were placed may have been compromised customer personal information.Information compromised may have included names, addresses, email addresses, payment card numbers, expirations dates and security codes. [source] | |

A&A Ready Mixed Concrete, Inc. had a data breach in 2016, in California. [source] | Abbott Nutrition had a data breach in 2017, in Ohio. [source] | |

ABM Parking Services had a data breach in 2014, in Missouri. ABM Parking Services notified customers of a data breach when the point of sale software system implemented by Datapark USA Inc, a third party vendor for several Chicago, Illinois parking facilities was hacked. The information was compromised from October 6, 2014 through October 31, 2014. The hackers were able to compromise certain customer credit and debit card information, including payment card numbers. A toll-free information line has been made available for those affected. [source] | Accuform Signs had a data breach in 2015, in Florida. Accuform Signs notified customers of a data breach when they noticed order information from their site and possible the site of a distributor of the company, which was hacked from an outside source. The information compromised included names, addresses, emails, phone and credit card information. [source] | |

Acer Service Corporation had a data breach in 2016, in California. [source] | Acosta Sales and Marketing had a data breach in 2014, in Florida. Acosta, Inc. and its subsidiaries (Mosaic Sales Solutions US Operating Co. LLC) informed customers of a data breach when an employee of their Human Resources department had a laptop containing personal information stolen from their car on November 11, 2014 [source] | |

Adult Friend Finder (owned by Penthouse Media) had a data breach in 2015, in Florida. The adult website Adult Friend Finder was hacked and personal information posted publicly for people to see.The information included customers' email addresses, usernames, passwords, birthdays and zip codes,and sexual preferences. To date they have not yet discovered if customer credit card information was exposed. [source] | Advanced Auto Parts had a data breach in 2016, in Virginia. Advance Auto Parts notified individuals of a data breach when the company suffered a phishing attack when an unauthorized individual posed as an employee, and convinced an employee of the company to provide a file containing information about certain individuals working for the company. The information compromised included names, Social Security numbers, 2015 gross wages, and the state(s) the individual pays income taxes. [source] | |

Advanced Graphic Products, Inc. /dba/ "Advanced-Online" had a data breach in 2017, in Texas. Advanced-Online, or Advanced graphic Products, Inc., experienced a data breach exposing 22,182 records. According to the breach notification form sent to the Indiana Office of Attorney General, Advanced-Online learned on January 3, 2018 that certain personal information housed on the company's online platform may have been subject to unauthorized access. The date range for the incident appears to be April 29, 2017until January 12, 2018. [source] | Advanced International Marketing Inc. had a data breach in 2016, in Ohio. Advanced International Marketing Inc. notified customers of a data breach when an unauthorized party gained access to certain images that were uploaded to the company's website. The information compromised included names and state ID's. [source] | |

Advanced Technology International, Inc. had a data breach in 2017, in South Carolina. On January 25, 2018, ATI began the process of mailing out Form 1099s to individuals and companies for the 2017 tax year. However, during the mailing process, an error occurred whereby approximately sixty-seven (67) recipients received their Form 1099 and the Form 1099 belonging to an unrelated individual or entity. On or around January 30, 2018, ATI discovered the error. ATI immediately commenced an investigation and confirmed the incident was the result of human error. ATI took steps to address the error to reduce the likelihood of a similar incident occurring in the future. [source] | Advanced-Online had a data breach in 2017, in California. Advanced-Online learned on January 3, 2018 that certain personal information housed on the company’s online platform may have been subject to unauthorized access. The date range for the incident appears to be April 29, 2017 until January 12, 2018. Upon becoming aware of the potential unauthorized access, Advanced-Online promptly engaged a nationally recognized cybersecurity and forensics firm to assess and address the situation. Advanced-Online and our cybersecurity and forensics firm believe that the following categories of information may have been compromised: name, address, username/email address, password, and payment card information (account number, expiration date, CVV number). [source] | |

AeroGrow International had a data breach in 2015, in Colorado. AeroGrow International Inc. informed customers of a data breach to their online servers when malware was detected on their system from October 15, 2014 through April 27, 2015. The information compromised included names, addresses, payment card account numbers, expiration dates, and CCV/CVV numbers. [source] | Aetna of Connecticut had a data breach in 2010, in Connecticut. A number of insured customers were affected by an unauthorized access or accidental disclosure of personal information in September. [source] | |

AHM, Inc. on behalf of the Staybridge Suites Lexington & Holiday Inn Express New Buffalo had a data breach in 2017, in Michigan. AHM, Inc. on behalf of the Staybridge Suites Lexington & Holiday Inn Express New Buffalo suffered a breach that affected 344 records, which included Account # and CC/DC account information. [source] | Alaska Communications had a data breach in 2014, in Alaska. Alaska Communications informed customers of a potential data breach on January 27, 2014. One of the company desktop computers was infected with a virus and subsequently sent data outside of their network. Possible personal information compromised could have included names, addresses, dates of birth, and Social Security numbers. The company stated they did not see any evidence of dependent, medical, or banking information that was compromised. The company is offering 1 year of AllClear ID protection at no cost and can be reached at 8-1-866-979-2593 for both AllClear Secure and AllClear PRO services.[source] | |

Allen Dell P.A. had a data breach in 2016, in Florida. [source] | Alliance Health had a data breach in 2015, in Utah. Alliance Health has put up a notification on their site regarding a databreach that potentially exposed their customers personal health information.\"Alliance Health had a configuration error in its MongoDB Database installation. The leak was reported to DataBreaches.net by Chris Vickery, who has uncovered other leaks including the Systema Software leak affecting numerous clients and millions of insurance or workers compensation claims.\" [source] | |

Alton Lane had a data breach in 2016, in New Hampshire. In late Nov. 2017, Alton Lane received notice that in or about November of 2017, malicious code was injected into its IT systems, allowing unauthorized access to certain data, including personal and financial information, that was stored on or managed by the systems. The time period of this code appears to have impacted users is approximately November of 2016 through November of 2017, unauthorized users may have had access to consumer information collected by Alton Lane via its website, affecting five (5) New Hampshire residents. [source] | Alton Lane had a data breach in 2017, in New Hampshire. In late November 2017, Alton Lane received notice that in or about November 2016, malicious code was injected into its information technology systems. Unauthorized users may have had access to consumer information collected by Alton Lane via its website. [source] | |

American Apparel, Inc. had a data breach in 2015, in California. [source] | American Association of Retired Persons, AARP Insurance had a data breach in 2010, in District Of Columbia. A client received another clients information in an insurance policy letter. He attempted to trace the mistake and notified the organization that underwrites AARPs life insurance program, New York Life Insurance. It is unknown how this error occurred and client names, phone numbers, policy numbers, check account information and dates of birth could have been exposed. [source] | |

American Bankers Association had a data breach in 2015, in District Of Columbia. American Bankers Association notified individuals of a data breach of their Shopping Cart affecting 6,400 records. The information compromised included Shopping Cart user names and passwords, which were posted online. At this time the company has stated that they do not believe that any financial information was compromised.The company is requesting that individuals change their online passwords. [source] | American Bankers Association had a data breach in 2015, in District Of Columbia. The American Bankers Association has notified customers of a data breach when email addresses and passwords used to make purchases on their site or used to register for events were compromised. "6,400 users' records had been posted online, the trade group said, though there was no evidence that credit card or other personal financial information had been accessed." [source] | |

American Express had a data breach in 2014, in New York. American Express sent out notification to cardholders regarding unauthorized activity on their cards from unnamed merchants. American Express has stated that names, card account numbers and expiration dates of cards could have been affected. At this time they have stated that no Social Security numbers have been affected.American Express has placed a fraud alert on their cardholders credit reports. [source] | American Express Company had a data breach in 2014, in New York. American Express announced, as part of an investigation by law enforcement and/or American Express, the company discovered a data breach that involved customer information. The data recovered included American Express cardholder acount numbers, names and other card information such as the expiration date. They have stated that Social Security numbers were not impacted and their systems did not detect any unauthorized activity on card holders accounts as related to this incident.UPDATE: (1/16/2014): American Express has sent out a new letter addressed to customers affected by the data breach. This new communication entailed information that one of the merchants that they purchased goods with was affected by the breach. The information breached did not change, in that card holder account numbers, names and other card information such as expiration date were compromised. No Social Security numbers were impacted. [source] | |

American Family Care had a data breach in 2014, in Alabama. American Family Care of Birmingham is alerting customers following the theft of two laptops containing sensitive information from an employee’s vehicle earlier this summer.The information on the laptops contained personal information of patients specifically related to work injuries, physicals, immunizations and drug screens. The lap top also included the names, dates of birth, addresses, phone numbers, medical record numbers, Social Security Numbers, additional medical information, insurance information, driver's license numbers and dates of service. [source] | American Optometric Association had a data breach in 2017, in Missouri. Another wave of malicious credit-line openings related to an ongoing suspected data breach are impacting students and doctors of optometry within the past week. These affected parties-like the initial group-report receiving unsolicited, fraudulent applications for Chase Amazon.com Visa cards submitted in their name. In some cases, these cards are approved.At the direction of the AOA's Board of Trustees, the AOA apprised federal authorities of the breach, including the U.S. Attorney General's Office (member login required) and Department of Justice. Additionally, the AOA called for a united front among affiliates and others, asking optometric testing organizations and state boards of optometry to immediately discontinue use of SSNs as personal identifiers. This petition resulted in the National Board of Examiners in Optometry (NBEO) eliminating the use of SSNs in favor of OE Tracker numbers. As of Jan. 26, the NBEO announced that its own months-long investigation into its systems found no evidence of compromised personal information. [source] | |

American Soccer Inc./SCORE had a data breach in 2014, in California. On October 21, 2014 SCORE discovered an unauthorized access to their server that processes customer payment information.According to the company on September 4, 2014 unauthorized access to their website compromised personal information of individuals who completed a transaction.The information includes names, payment card account numbers, expiration dates of cards, SCORE account numbers. Those who were affected conducted a transaction between June 1, 2014 and September 4, 2014. There was no evidence that customer addresses or security codes being compromised after an investigation was conducted.For those with questions or concerns call 1-800-626-77741-800-626-7774. [source] | American Tire Distributors had a data breach in 2017, in North Carolina. [source] | |

America's Job Link Alliance had a data breach in 2017, in Kansas. Hackers have breached America's Job Link Alliance (AJLA), a job portal offered by the Department of Labor (DOL), and stolen personal details from an undisclosed number of job seekers.AJLA, a multi-state database of US job seekers, acknowledged the security breach through a message on its website.Hackers stole information from job seekers in 10 statesAccording to AJLA officials, hackers registered an account on the job portal and then used a vulnerability in the AJLA source code to extract data from other users.An investigation revealed hackers managed to get access to names, dates of birth, and Social Security Numbers for users in ten of the sixteen states catered by the AJLA portal.Affected states include Alabama, Arizona, Arkansas, Delaware, Idaho, Illinois, Kansas, Maine, Oklahoma, and Vermont. Currently, job seekers in Georgia, Indiana, Kentucky, Nevada, New Jersey and Massachusetts don't appear to be affected.[source] | America's Thrift Stores had a data breach in 2015, in Georgia. America's Thrift Stores notified customers of a data breach when they thrift store chain discovered the software used through a third-party service provider was compromised.The hacking, alledgedly from Eastern Europe, compromised customer credit card or debit card information was compromised. [source] | |

Ameritas Life Insurance Corp. had a data breach in 2012, in Nebraska. A laptop was stolen or discovered stolen sometime around March 21, 2012. It contained the sensitive health information of 3,000 people. The incident was posted on the HHS website on June 8.UPDATE(08/03/2012): An official notice states that an employee notified Ameritas that their laptop and other items were stolen from their car on March 21. The laptop contained information used to provide group dental and vision quotes, as well as individual member enrollment information for employer-sponsored group health plans. The laptop was password protected but not encrypted. Names, Social Security numbers, addresses, dates of birth, and places of employment may have been exposed. [source] | Ancestry's RootsWeb.com had a data breach in 2017, in Utah. Ancestry's RootsWeb.com server, which hosts a free genealogical community site, exposed a file containing emails, login information, and passwords of 300,000 users.hile the 300,000 accounts were affiliated with RootsWeb.com's surname list service that it retired earlier this year, 55,000 of the user names belonged to both the free RootsWeb.com site and also to Ancestry.com, which charges for some of its genealogical services. The company noted that 7,000 of the emails and log-in credentials belonged to active Ancestry.com users.RootsWeb does not host sensitive information like credit card and social security numbers, the company stated, further noting it has "no reason to believe that any Ancestry systems were compromised." [source] | |

Anthem Blue Cross Blue Shield had a data breach in 2017, in Indiana. Anthem BlueCross BlueShield began notifying customers last week of a breach affecting about 18,000 Medicare members. The breach stemmed from Anthem’s Medicare insurance coordination services vendor LaunchPoint Ventures, based in Indiana.LaunchPoint discovered on April 12 that an employee was likely stealing and misusing Anthem and non-Anthem data. The employee emailed a file containing information about Anthem’s members to his personal address on July 8, 2016.The file contained Medicare ID numbers, including Social Security numbers, Health Plan ID numbers, names and dates of enrollment. Officials said limited last names and dates of birth were included. [source] | Anthem had a data breach in 2015, in Indiana. Anthem, the second largest health insurance company operating under Anthem Blue Cross, Anthem Blue Cross and Blue Shield Amerigroup and Healthlink has suffered a massive data breach.The company announced that they have been the victim of a "very sophisticated external cyber attack" on their system. The information compromised includes names, birthdays, medical ID's, Social Security Numbers, street addresses, e-mail addresses, employment and income information. [source] | |

Anthem had a data breach in 2017, in Indiana. [source] | Apple America Group LLC had a data breach in 2015, in Ohio. Apple America Group, LLC informed employees of a data breach when a portable USB flash drive owned by a third party vendor containing payroll information was lost.The information on the portable usb drive included names, addresses, Social Security numbers, and wage and tax information. [source] | |

Apple had a data breach in 2014, in California. Apple has revealed a security protocol breach of their iOS and OS X systems. The hacker was able to insert him/herself between the initial verfication and verification session's destination server. This type of hacking allows the hacker to take over as the trusted user. The destination server sees the hacker as the trusted user and will then allow the hacker to access secured connections such as websites, email messages, applications where you would typically enter a user id and password. [source] | Aptos Inc had a data breach in 2017, in Georgia. Shoppers of 40 online stores have had their bank card numbers and addresses slurped by a malware infection at backend provider Aptos.The security breach occurred late last year when a crook was able to inject spyware into machines Aptos used to host its retail services for online shops. This software nasty was able to access customer payment card numbers and expiration dates, full names, addresses, phone numbers and email addresses, we're told.Rather than being alerted to the infiltration by Aptos itself, instead we were warned this week by Aptos' customers – the retailers whose websites were infected by the malware on the backend provider's servers.According to these stores, which have had to file computer security breach notifications with state authorities, the malware was active on Aptos systems from February through December of 2016. [source] | |

Arby's had a data breach in 2017, in Georgia. Sources at nearly a half-dozen banks and credit unions independently reached out over the past 48 hours to inquire if I’d heard anything about a data breach at Arby’s fast-food restaurants. Asked about the rumors, Arby’s told KrebsOnSecurity that it recently remediated a breach involving malicious software installed on payment card systems at hundreds of its restaurant locations nationwide.A spokesperson for Atlanta, Ga.-based Arby’s said the company was first notified by industry partners in mid-January about a breach at some stores, but that it had not gone public about the incident at the request of the FBI."Arby’s Restaurant Group, Inc. (ARG) was recently provided with information that prompted it to launch an investigation of its payment card systems," the company said in a written statement provided to KrebsOnSecurity. [source] | Arkansas Blue Cross and Blue Shield had a data breach in 2015, in Arkansas. On June 16, 2015, two unencrypted desktop computers containing the protected health information (PHI) of approximately 560 individuals were stolen from the business associate (BA), Treat Insurance Agency, at its North Little Rock offices. The BA is an insurance broker that solicits and submits applications for health insurance coverage to the covered entity (CE), Arkansas Blue Cross and Blue Shield. The types of PHI involved in the breach included demographic, clinical and financial information. The CE provided breach notification to HHS, affected individuals, and the media. OCR reviewed the BA agreement in place between the CE and the BA and determined that the BA agreement was compliant with 45 C.F.R. §§ 164.314 and 164.504. Location of breached information: Desktop Computer Business associate present: No [source] | |

ArmorGames had a data breach in 2014, in California. [source] | Ashley Madison (owned by Canadian Avid Life Media) had a data breach in 2015, in Ontario. Ashley Madison, the online cheating website, confirmed a hack of their system, exposing 40 million records.The data that was stolen included the company's user databases, financial records along with other confidential information. The company has not stated the exact personal information compromised."Reached by KrebsOnSecurity late Sunday evening, ALM Chief Executive Noel Biderman confirmed the hack, and said the company was "working diligently and feverishly" to take down ALM’s intellectual property. Indeed, in the short span of 30 minutes between that brief interview and the publication of this story, several of the Impact Team’s Web links were no longer responding. Besides snippets of account data apparently sampled at random from among some 40 million users across ALM’s trio of properties, the hackers leaked maps of internal company servers, employee network account information, company bank account data and salary information." [source] | |

AT&T had a data breach in 2014, in Texas. AT&T is at the center of another data breach to their system, this time, by an internal employee. AT&T has announced that one of its staff members accessed account information of customers, which included Social Security Numbers, drivers license numbers, unique customer numbers, known as Customer Proprietary Network Information (CPNI), which includes information such as times, dates, durations and destination numbers of every call made. No specific numbers have yet been released.(10/7/2014): The Vermont Attorney General posted that 1,600 letters went out to customers regarding the recently announced data breach that happened in August of 2014 by an employee of AT&T. The employee has since been fired and the breach is still under investigation. [source] | Atkinson, Andelson, Loya, Ruud & Romo had a data breach in 2015, in California. The lawfirm of Atkinson, Andelson, Loya, Ruud & Romo notified clients of a data breach, when one of their attorney's laptops was stolen that contained personal information of their clients.The personal information on the laptop included names, addresses, telephone numbers, Social Security numbers, possible financial information, and medical records information. The firm is providing MyIDCare, ID Experts for free for 12 months for those who were affected. They can be reached by calling 1-877-341-4604. Monday through Friday from 6:00 a.m to 6 p.m Pacific Time. [source] | |

Atlantic Automotive Corporation/dba One Mile Automotive had a data breach in 2014, in Maryland. One Mile Automotive is notifying customers of a data breach of one of their third party vendors, Trade Motion who operates automobile websites and has notified One Mile Automotive that this breach could have included personal information of some of its customers.The information included names, addresses, email addreasses, telephone numbers, credit card information. [source] | Atlantis, Paradise Island had a data breach in 2016, in Grand Bahama. Atlantis, Paradise Island (the "Resort") today announced that a recent data security incident may have compromised the security of payment information of some customers who used debit or credit cards at food and beverage and retail locations at the Resort between March 9, 2016 and October 22, 2016. Customers can now safely use their credit and debit cards at the food and beverage and retail locations at the Resort. This incident did not affect credit and debit cards used to make or pay for hotel reservations or purchases made by guests who charged their food and beverage or retail purchases back to their room.What Happened? The Resort began investigating unusual activity after receiving reports from its credit card processor. The Resort immediately began working with third-party forensic experts to investigate these reports and to identify any signs of compromise on its computer systems. On October 21, 2016, the Resort discovered suspicious files on its computer systems that indicated a potential compromise of customers’ credit and debit card data for some credit and debit cards used at food and beverage and retail locations at the resort.Since that time, the Resort has been working with third-party forensic investigators to determine what happened and what information was affected. The Resort has confirmed that malware may have captured data from some credit and debit cards used at food and beverage and retail locations at the Resort. The Resort has removed the malware at issue to contain this incident and implemented additional procedures in an effort to prevent any further unauthorized access to customers’ credit and debit card information. [source] | |

Auto Pride Car Wash had a data breach in 2017, in California. Auto Pride Car Wash was informed on March 27, 2017 that our point-of-sale system experienced an intrusion last month. Our point-of-sale system is operated by a third-party platform provider and this provider experienced the intrusion. To date, the investigation indicates that the intruder placed malware on the point-ofsale system, and by doing so gained access to our customers’ payment card data, including the cardholder’s first and last name, payment card number, and security code. If you used a payment card at any of our locations between the dates of 02/11/17 – 02/27/17, your payment card information may be at risk. Because we are unable to determine contact information for each customer whose information may be at risk, we are notifying our customers of this risk in this Substitute Notice. What information was involved? For those customers who used a payment card at our location(s) between the dates of 02/11/17 – 02/27/17, the information the intruder had access to includes the cardholder’s first and last name, card number and security code. [source] | Automotive Recovery Services Inc. had a data breach in 2015, in Illinois. Automotive Recovery Services (ARS) notified customers of a breach when an unauthorized party gained access to one of their legacy systems compromising customer information.The information compromised included names, Social Security numbers, street addresses, email addresses, phone numbers, driver's license numbrs, the type of vehicles donated, name of the charity that the vehicle was donated to.The company is providing identity theft protecton for 12 months for free with AllClear ID. For those with a questions call 1-855-861-4023.More Information: http://oag.ca.gov/ecrime/databreach/reports/sb24-56920 [source] | |

AutoNation Toyota of South Austin had a data breach in 2014, in Texas. AutoNation Toyota of South Austin informed customers of a data breach that occured when a third party vendor, TradeMotion, who operates parts websites for auto dealers nationwide, had their systems hacked potentially exposing credit card information that was stored on their system. The hackers may have also gotten names, addresses, telephone numbers, and email addresses.The company has arranged for those affected to receive one year of identity theft protection through Experian's ProtectMyID. [source] | Avis Budget Group had a data breach in 2015, in New Jersey. Avis Budget Group notified customers of a data breach when the third-party provider that manages their open enrollment process accidentally sent a file to another company that is also their client. The information exposed to this other client included names, addresses and Social Security numbers. [source] | |

AvMed Health Plans had a data breach in 2010, in Florida. AvMed Health Plans announced that personal information of some current and former subscribers may have been compromised by the theft of two company laptops from its corporate offices in Gainesville. The information included names, addresses, phone numbers, Social Security numbers and protected health information. The theft was immediately reported to local authorities but attempts to locate the laptops have been unsuccessful. AvMed determined that the data on one of the laptops may not have been protected properly, and approximately 80,000 of AvMeds current subscribers and their dependents may be affected. An additional approximate 128,000 former subscribers and their dependents, dating back to April 2003, may also have been affected.UPDATE (06/03/2010): The theft of the laptops compromised the identity data of 860,000 more Avmed members than originally thought. The total now nears 1.1 million. [source] | Ayuda Medical Case Management had a data breach in 2012, in Texas. Thousands of patient records were found in an unsecured trash can. They contained names, Social Security numbers, addresses, phone numbers, medical conditions, and treatment information. The boxes of medical records were traced to Ayuda, whose owner claimed to have been doing little or no business after losing a state contract in September. The boxes were auctioned off after the owner failed to pay the rental fee on a storage unit. [source] | |

Backcountry Gear had a data breach in 2014, in Oregon. Backcountry Gear notified customers of a data breach with a server that handles credit card information. The company discovered malware that was put onto their server that was able to gain customer names, addresses, purchase information, and credit card/debit card information. The company has stated they do not collect pin numbers or bank account numbers in a transaction so those would not have been compromised in the breach.For those who were affected and have questions can call 1-800-953-5499 ext. 5 or email at data@backcountrygear.com. [source] | Bailey's Inc. had a data breach in 2016, in California. Bailey's Inc. have notified customers of a data breach when an unauthorized party access their website server, obtaining credit card information of customers who puchased items from the company's online store. [source] | |

Bartell Hotels had a data breach in 2014, in California. Name, address, credit/debit card info were breached. [source] | BB&T Insurance had a data breach in 2008, in Virginia. A BB&T Insurance laptop containing the personnel information of some Harrisonburg City Schools employees was stolen. The laptop, used by an outside sales representative to develop an insurance proposal for the school system, was stolen from a car. The information contained names, dates of birth, Social Security numbers, and, in some cases, medical history. [source] | |

BeautifulPeople.com had a data breach in 2016, in New York. BeautifulPeople.com notified individuals of a data breach when their system was hacked compromising personal information. The information included member's names, addresses, sexual preferences, relationship status, phone numbers, email addresses and private messages. [source] | BeautyBlender had a data breach in 2017, in Pennsylvania. Beautyblender was recently contacted by two customers reporting fraud on credit cards used to make purchases on our site. Beautyblender discovered what it believed was a form of malicious code on its site on October 26, 2017 which it then removed. The specific information that may have been obtained by the unidentified third party included the customers’ name, billing address, full credit card number, expiration date, and CVV number, affecting 3,673 California residents. A third party forensic investigator was also retained to assist with beautyblender’s investigation. On November 27, 2017, the forensic investigator confirmed that the malware inserted into the website collected certain payment card information used at checkout.On January 5, 2018, beautyblender will begin providing written notice of this incident to all potentially affected customers, which includes three thousand, six hundred and seventy-three (3,673) California residents. On January 5, 2018, beautyblender will begin providing written notice of this incident to all potentially affected customers, which includes three hundred and nine (309) Oregon residents. [source] | |

Bebe Retail had a data breach in 2014, in California. Name and payment card info were breached. [source] | Bed Bath & Beyond, Inc. had a data breach in 2018, in New Jersey. A call center employee processing orders over the phone illegally compromised three customers' credit card information. BB&B recently determined that this same employee processed an order for one North Carolina resident over the phone between November 21, 2017 and December 8, 2017, although they do not know if that customer's credit card number was compromised. [source] | |

Bed Bath and Beyond had a data breach in 2015, in New York. Bed Bath and Beyond notified customers of a data breach in their New York city store, between March 7, 2015 and August 3, 2015. Customers who used their cards during that time period have been encouraged to notify their banks of the potential for credit card theft. [source] | Benefits Resources, Inc. had a data breach in 2011, in Ohio. A portable electronic device was lost or stolen on or around November 22, 2010. It contained the PHI of patients. [source] | |

Best Buy had a data breach in 2017. [source] | Beyond Yoga had a data breach in 2016, in California. [source] | |

Big Blue Bus had a data breach in 2015, in California. The Big Blue Bus has notified customers of a data breach when the company discovered unauthorized access at NextBus, a third party company that Big Blue Bus works with to provide real-time bus arrival information to customers. The individual (s) may have gained accress to account information of customers. The company claims that no Social Security numbers or financial information was compromised. [source] | Big Fish Games had a data breach in 2015, in Washington. Big Fish contacted customers of a data breach when they discovered malware installed on their billing and payment pages of their online stores that affected purchases from December 24, 2014 through January 8, 2015. The information affected included names, addresses, and payment card information, including the card number, expiration date, and CVV2 code. The company is providing one year free of Experian's ProtectMyID Alert. [source] | |

BigMoneyJobs.com had a data breach in 2014. [source] | Billy Casper Golf had a data breach in 2016, in Virginia. The information was breached via Email. [source] | |

Black Phoenix, Inc had a data breach in 2018, in California. [source] | Bloomberg had a data breach in 2017, in New York. [source] | |

Blue Beacon had a data breach in 2018, in California. [source] | Blue Cross and Blue Shield of Florida (BCBSF) had a data breach in 2011, in Florida. An April 2011 mailing error caused 3,500 member healthcare statements to be mailed to incorrect addresses. The statements were mailed to the former addresses of members and contained names, insurance numbers, diagnoses codes and descriptions, procedure codes and descriptions, prescription names and provider names. [source] | |

Blue Cross and Blue Shield of Georgia had a data breach in 2008, in Georgia. Benefit letters containing personal and health information were sent to the wrong addresses. The letters included the patients name and ID number, the name of the medical provider delivering the service, and the amounts charged and owed. A small percentage of letters also contained the patients social Security numbers. [source] | Blue Cross and Blue Shield of Kansas City, Inc. had a data breach in 2014, in Maryland. Name, credit card info, bank account info were breached via Desktop Computer. [source] | |

Blue Cross and Blue Shield of North Carolina had a data breach in 2006, in North Carolina. [source] | Blue Cross and Blue Shield of Rhode Island (BCBSRI) had a data breach in 2010, in Rhode Island. A filing cabinet containing survey information from approximately 12,000 BlueCHIP for Medicare members was donated to a local nonprofit organization. The surveys were from 2001 to early 2004 and contained information such as names, Social Security numbers, telephone numbers, addresses and Medicare Identification numbers. [source] | |